I remember the good old days when we only had to worry about small banks going out of business. Then big banks started to go out of business, then non-bank financial institutions, and now small countries.

The problem with having a lot of debt is that, with some exceptions (“too big to fail”), bad things happen when your investors get nervous.

My memory is not photographic as some of the legends about me say, but I am sure I would remember if the works of Adam Smith included the phrase “too big to fail.” — Garry Kasparov

What are the odds that people running companies or countries will make smart decisions about money if they don’t need to make smart decisions — if they can do just as well or better making dumb decisions and being rescued from the consequences?

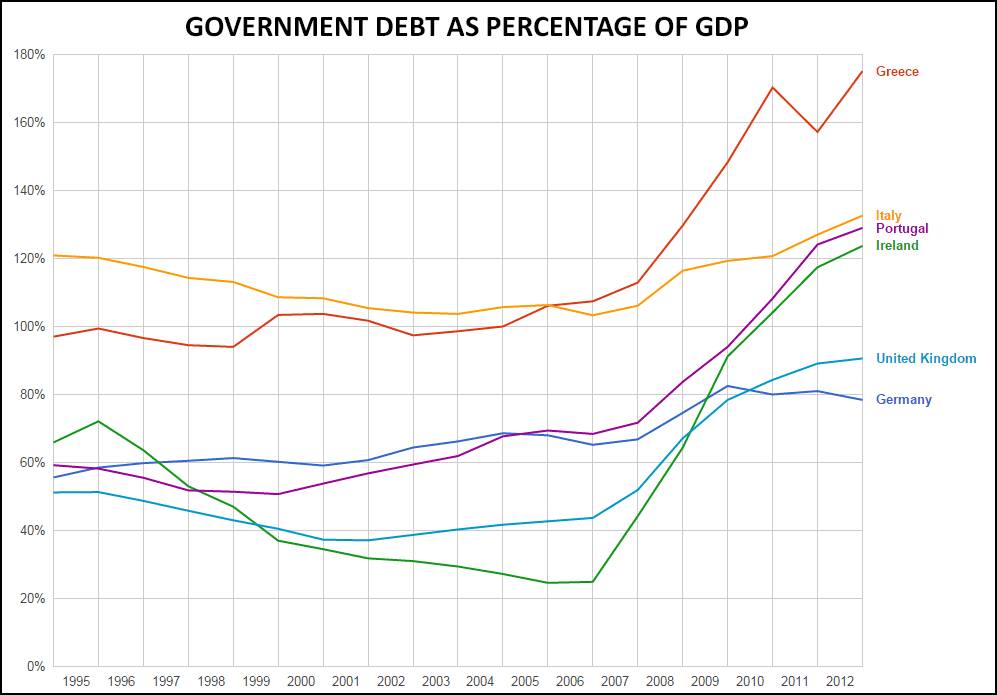

According to the government debt chart below, the next countries in line for a day of reckoning are two more small countries (Ireland, Portugal) and a medium-sized country (Italy). Further down the chart are two big countries.

The United States, the biggest of the big, is not shown on the chart but is currently at 100 percent debt to GDP.