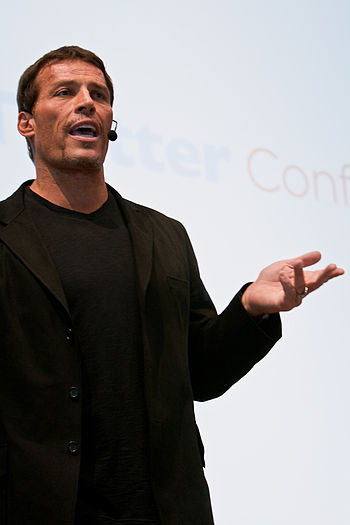

Tony Robbins has 6 tips for Building Wealth Now. Let’s look at each of the tips and apply the “would anyone advise the opposite?” filter to assess the value of Robbins’ advice.

- Don’t lose money. I’m not kidding, that’s the first tip. Would anyone advise “Lose money”? No. So this “tip” is useless.

- Look for investments in which rewards far outweigh risks. Would anyone advise “Look for investments in which risks far outweigh rewards’? No. Robbins recommends using “the 5-to-1 rule,” in which the potential returns on an investment are 5 times greater than the potential losses. Why 5? Why not 10? Or 100? Where do you find these investments? I have no idea.

- Don’t overpay taxes. Would anyone advise “Overpay taxes”? No.

- Diversify. Would anyone advise “Don’t diversify”? Possibly. There’s a couple of schools of thought on diversification: 1) Don’t put all your eggs in one basket; and 2) Put all your eggs in one basket, then watch that basket. So there’s a tip for you: Diversify.

- Watch out for mindless spending. Would anyone advise “Spend mindlessly”? No. Robbins says if you spend $40 a week on restaurant meals, consider inviting friends over for a low-cost dinner at home instead. “In a year, you’ll have saved $2,000. If you invest that $2,000 every year, in 40 years you’ll have half a million dollars.” No, in 40 years you’ll have $80,000. Maybe. Given some assumptions about your rate of return, you might have half a million dollars, but on the other hand, you might make some bad investments and wind up with nothing.

- Stop sabotaging yourself. Would anyone advise “Sabotage yourself”? No.